Vietnam’s preferential investment policies for businesses

This article from SMART SOLUTION FOR BUSINESS COMPANY LIMITED (S4B Vietnam) summarizes the performance of enterprises with foreign direct investment (FDI) in Vietnam in the period from 2012 to 2017, from analyzing preferential investment policies for this type of business. In this industry, the author proposes some solutions to improve the efficiency of attracting and managing foreign investment capital into Vietnam.

1. FDI enterprises have high demand for product localization

Foreign investment plays a crucial role as one of the primary drivers promoting Vietnam’s economic growth. The contribution of the foreign investment sector to the country’s GDP increased from 9.3% in 1995 to 19.6% in 2017. Additionally, the foreign investment sector consistently maintains high labor productivity, making a significant contribution to enhancing the overall labor productivity of the economy. According to statistics, as of the end of December 2017, there were 21,456 enterprises with foreign direct investment (FDI).

2. Evaluate financial incentive policies

Vietnam has continuously improved institutions and preferential financial policies to attract and better manage foreign investment resources. In general, financial incentives focus on three areas: (i) Corporate income tax incentives, (ii) Import-export tax incentives and (iii) Land finance incentives. Specifically:

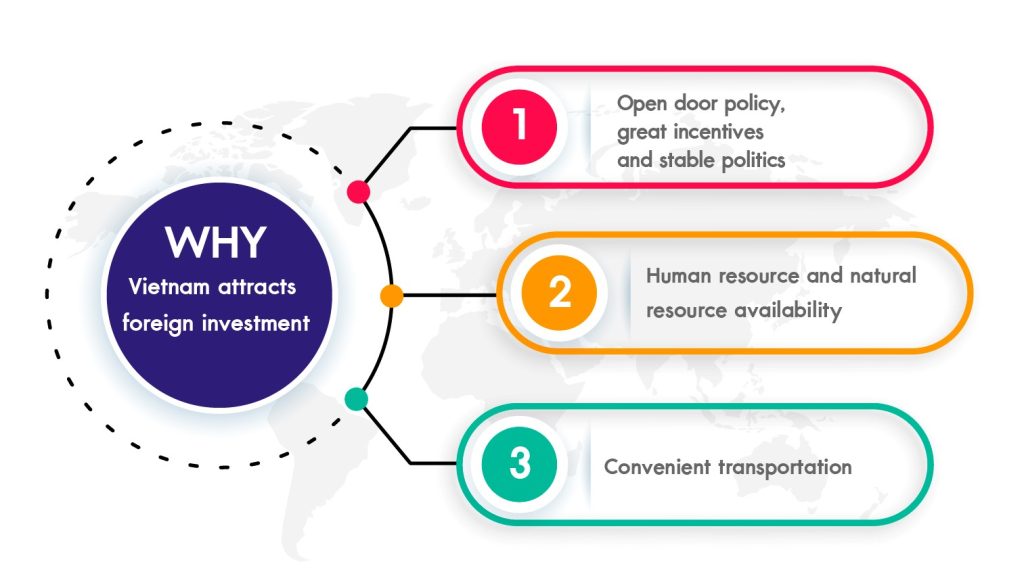

Why Vietnam’s Economy Presents Opportunities for FDI enterprises.

>>>Read more: Staffing in human resource management

2.1 Corporate income tax incentives

To encourage investment on the basis of ensuring revenue, Vietnamese Government has reduced the tax burden through reducing tax rates, simplifying the tax system, expanding taxable subjects, and eliminating the tax on transferring profits abroad since 2003. During this period, tax policy contributed towards eliminating discrimination between economic sectors, between domestic enterprises and FDI enterprises.

In addition to the reduction of the general tax rate stipulated by amendments to the Corporate Income Tax Law (28% for the period 2004-2008, 25% for the 2009-2013 period, 22% for the 2014-2015 period, and 20% from January 1, 2016, to the present), the provision of high corporate income tax incentives for several key sectors requiring investment encouragement has contributed to attracting investments, fostering business activities, and creating favorable conditions for businesses to accumulate, increase investment in the economy, and promote growth.

2.2 Incentives on import and export tax

From 2001 to the present, Vietnam has consistently enhanced its export tax and import tax policies to align with international commitments. By September 2019, Vietnam had actively participated in negotiating and implementing 17 free trade agreements. To fulfill integration commitments, streamline preferential export policies, and attract Foreign Direct Investment (FDI), the Law on Export and Import Taxes underwent successive updates and amendments in 2001, 2005, and 2016. Some notable modifications include the inclusion of high-tech enterprises, science and technology enterprises, as well as science and technology organizations, being exempt from import tax for raw materials, supplies, and components that cannot be domestically produced within the initial 5 years of production commencement.

2.3 Incentives on land finance

From 2005 to present, to support businesses, the Government has issued many support policies and solutions.

To attract investment, enhance management and effective use of land financial resources in economic zones and high-tech zones, the Government issued Decree No. 35/2017/ND-CP dated March 3, 2017. April 2017 regulates the collection of land use fees, land rent, and water surface rent in economic zones and high-tech zones with many incentives.

3. The positive effects of financial incentive policies on attracting FDI enterprises

- Tax incentive policies have made a certain contribution to mobilizing and attracting resources, especially foreign investors, to invest in developing production and business, promoting exports and ensuring the economy. economic growth.

- Tax incentive policies ensure the goal of international economic integration, in accordance with development trends, in accordance with international treaties and commitments that Vietnam has signed or participated in or is in the process of negotiation process.

- Create a transparent and favorable environment to promote the attraction of foreign investment capital, encourage newly established businesses or invest more capital, expand scale, and improve production capacity.

- Create a positive shift in structure and proportion between industries, regions and regions.

Vietnam continues to attract foreign capital in 2023

4. Some limitations still exist.

Besides the positive impacts on financial incentive policies, there are also some limitations and shortcomings as follows:

- Although tax incentive policies apply uniformly to all economic sectors, economic sectors with FDI capital are benefiting more from preferential policies.

- Integrating social policies into corporate income tax incentive policies makes tax policies more complicated, difficult to manage, and easily creates loopholes for businesses to take advantage of tax reductions, causing inequity in tax practices. tax officer between subjects.

- Incentive policies are unstable, so businesses cannot predict business performance in the medium and long term, which is also the reason that limits the attraction of domestic and foreign investment to promote economic development.

SMART SOLUTION FOR BUSINESS COMPANY LIMITED (S4B Vietnam)

- Address: Unit 701B-701C, Tower A, Handi Resco, 521 Kim Ma Street, Ba Dinh District, Hanoi, Vietnam

- Tel: + 84 24 3974 4181

- Email: service@s4b.com.vn

——————————————–

We Will Show You The Way To Success!