The process helps businesses strictly manage debt

How to optimize debt management is a question of particular interest to administrators and accountants. Selling to customers who owe money can pose potential risks leading to bad debts and difficulties in debt collection. However, this is a popular and easy way to quickly increase sales and profits during your business operations.

In addition to common receivables and payables, businesses also have other debts that need attention such as advance debts, internal debts, tax debts, insurance, banking. Scope of article This article will share with you how to optimize debt management, to help minimize risks in the debt management process at businesses.

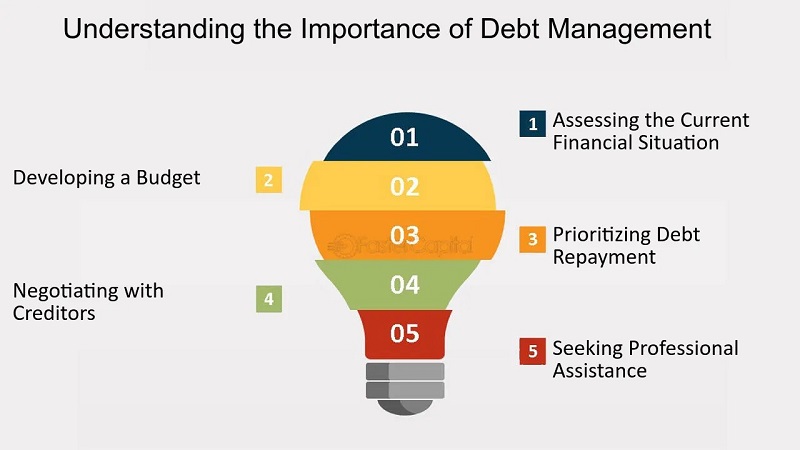

1. The importance of debt management

1.1. What is debt management?

Debt management is the process of recording, reflecting, monitoring and handling receivable debts (for customers) arising during the sales process and payable debts (for suppliers) arising during the sales process. the purchasing process of a business over a specified period of time (usually a month).

In addition to receivables and payables, businesses also have other debts that need to be managed such as advance debts, internal debts, tax debts, insurance, banking.

Effective Ways of Managing Business Debt

>>>Read more: Professional bookkeeping services in Vietnam

1.2. The importance of managing receivables and payables

Poor management of receivables (for businesses that are suppliers) can lead to bad debt (hard to collect), even debt cannot be recovered. Then the business can suffer losses. The burden of not being able to collect money from sales leads to being forced to write off debt. The most typical case is when a business relaxes policies to increase sales, leading to profit reporting but negative cash flow, potentially high financial risk.

2. Important contents of debt management

Debts in a business include:

- Accounts receivable from customers;

- Debts payable to suppliers;

- Other debts

To manage debt optimally and effectively, businesses first need a debt management process. Depending on management needs, each business will have its own way of building its own process to suit its production and business activities as follow:

2.1. Manage customer receivables

Step 1: Update information and customer grouping

Based on the amount of goods customers buy in a month and payment history, businesses can group customers who buy a lot and pay well. From there, they can set up sales policies, debt credit limits, and discounts.

Step 2: Record arising, control and notify debt

Records and documents used to record and reflect debt as a basis for debt recovery include:

- Types of contracts such as: Principle contract, sales contract or economic contract.

The contract should specify the time and method of payment, debt credit limit (if any) in addition to the mandatory provisions required by law related to contract drafting; - Warehouse release note, Material and goods handover record, CO, CQ release certificate, Sales invoice, Value added invoice.

- Detailed book of customer receivables.

- Minutes of reconciliation and confirmation of debts.

Importance of Debt Management

Step 3: Proceed to collect debt

To speed up the debt collection process, at the beginning of each month, debt accountants or people in charge of debt collection need to complete documents early and send them to the debt collection department (if the company does not have a debt collection department, then directly perform debt accounting).

Step 4: Handle bad or unrecoverable debt

For debts that are still unrecoverable after the debt term expires, it is necessary to classify them according to debt age (debt period) to have an appropriate debt collection plan and make provisions according to regulations. Normally, debt age is determined by the number of days the debt is overdue such as: Over 30 days, 45 days, 60 days.

2.2. Manage accounts payable to suppliers

Similar to customer receivables, supplier payables can be managed like receivables in the first three steps. Step 4 in the payables management process is not necessary. Regarding payable debt management, suppliers also need to pay attention to the issue of debt recognition (in the purchase price), purchasing policy and good staff management to avoid losses for the business.

3. Tools to support debt management

To manage debt well and effectively, in addition to human issues, businesses also need supporting software such as Excel (manual), sales software, accounting. Although using accounting software or sales software can increase costs, when managing debt, it will avoid confusion and create reports at the time managers need them.

With the Excel tool, debt management is still manual and can be confusing in data entry, which is both time-consuming and does not meet management requirements. Some businesses both manage software and use excel to create the types of reports managers want.

Through the article Smart Solutions For Business Company Limited (S4B Vietnam) hopes you will understand the importance of debt management and partly orient how to optimally and effectively manage debt and apply it in your business. Businesses and accountants interested in debt management solutions please contact us for more information!

S4B Vietnam

- Address: Unit 701B-701C, Tower A, Handi Resco, 521 Kim Ma Street, Ba Dinh District, Hanoi, Vietnam

- Tel: + 84 24 3974 4181

- Email: service@s4b.com.vn

——————————————–

We Will Show You The Way To Success!